Corporate Recovery & Insolvency

Corporate Recovery & Insolvency

Minimizing losses and maximizing recoveries from bankruptcy is indeed possible.

Today’s business environment is volatile, and no one knows what will happen next. Especially during difficult times, some businesses may find it challenging to recover credits or discharge debts, necessitating the need for corporate recovery.

The current COVID-19 pandemic has slowed both the global and local economies. Various business sectors and industries have been severely impacted, causing many businesses in Indonesia to declare bankruptcy and/or insolvency.

To assist businesses and companies in Indonesia and help them survive during this unfortunate time, we offer corporate recovery and bankruptcy or insolvency services that can help you in weathering the storm.

Procedures for Bankruptcy Filing and Debt Suspension (PKPU) Filing in Indonesia

Bankruptcy filing and debt suspension filing in Indonesia are somewhat complicated. It would be wise to consult with insolvency and bankruptcy professionals who can explain the procedure of corporate recovery in great detail and assist you in every step.

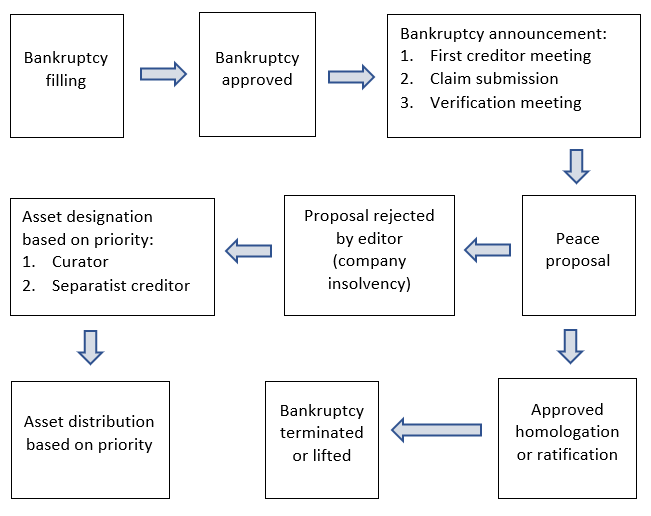

BANKRUPTCY FILING PROCESS

Filing bankruptcy can help business owners by discharging debts or making repayment plans. In short, the procedure for filing bankruptcy in Indonesia is as follows:

- File bankruptcy: it can be either self-filing or filing by creditors. Wait approximately 30 days to see whether a bankruptcy filing is approved or rejected.

- If the bankruptcy filing is approved, schedule a meeting with creditors to discuss a settlement proposal.

- If approved, the bankruptcy will be terminated or lifted, followed by homologation or verification.

Note: If the application is rejected, asset designation is next, followed by asset distribution.

In addition to filing for bankruptcy, business owners can also file for debt suspension. When debt suspension filing is approved, creditors agree to suspend the scheduled payments so that debtors can allocate their resources to coping with and surviving a difficult time.

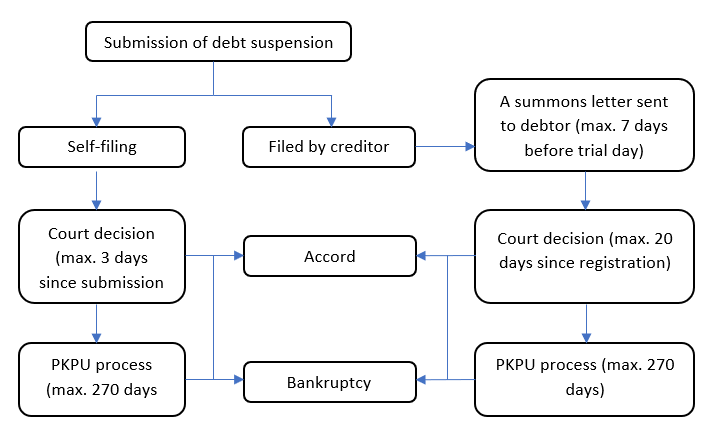

The procedure for filing PKPU in Indonesia is as follows:

PKPU FILING PROCESS

- File PKPU: it can be either self-filing or filing by the creditor.

- For self-filing: wait for a court decision within three days and go through the PKPU process (max. 270 days). If approved, an accord will be issued. If rejected, you will be declared bankrupt and arrange a meeting with creditors (see Procedure for Bankruptcy Filing – step 3).

- For filing by creditors: issue a summons letter to the debtor within seven days before the day of the trial, wait for a court decision within 20 days and go through the PKPU process (max. 270 days). If approved, an accord will be issued. If rejected, you will be declared bankrupt and arrange a meeting with creditors (see Procedure for Bankruptcy Filing – step 3).