Tax Consulting

Tax Consulting in Indonesia

It is critical to stay completely compliant with local regulations wherever you do business. In Indonesia, neither an individual nor a company can avoid paying taxes. On the other hand, tax reporting and other related processes can be daunting and exhausting due to the complex and ever-changing laws. That is when tax consulting in Indonesia can come in handy.

Key Services

A. Tax Consulting Indonesia – Why it is Important for Your Business

Incorrectly filed tax returns may result in further investigation by the authorities. Tax and accounting services in Indonesia are shortcuts to meeting these administrative obligations accurately and on time.

Tax consultants in Indonesia can also help you save time and money by keeping up with the latest regulatory changes, as they have extensive knowledge of local policies.

B. Tax Consulting Indonesia with Abisnis

Abisnis takes pride in its team of experienced Indonesian accountants and tax consultants who are well-trained and have local business knowledge. We provide tax consulting services tailored to your needs from Jakarta, Semarang, and Bali branches.

With our assistance, you can save money on recruiting, training, and accounting software and put it toward day-to-day operations that will help your business grow.

C. Type of Tax in Indonesia

- PERSONAL INCOME TAX

The Indonesian government collects personal income tax from all residents based on their earnings from salaries, interests, dividends, pension funds, and other sources. Although individual income tax is levied on earners in Indonesia, employers are responsible for calculating and paying taxes to the authorities. Every month, employers should pay these taxes on behalf of the taxpayers. It should note that tax residents without an Indonesian Taxpayer ID (NPWP) may face higher rates. - CORPORATE INCOME TAX

Indonesia’s corporate income tax is charged to any business entity earning income there. Although most businesses pay a flat rate, some industries have their own corporate income tax rates. For more information, please contact one of our tax consultants. - VALUE-ADDED TAX

Most goods and services in the Indonesian market are subject to Value-Added Tax (VAT), also known locally as Pajak Pertambahan Nilai (PPN). In Indonesia, VAT is levied at each stage of production. Companies classified as Pengusaha Kena Pajak, or PKP, must report their VAT and related business activities monthly. - IMPORT TAX

In addition to VAT, import tax can be levied in Indonesia on goods and products imported from other countries. However, this obligation may be exempted under certain conditions depending on the product type, region, or country of origin.

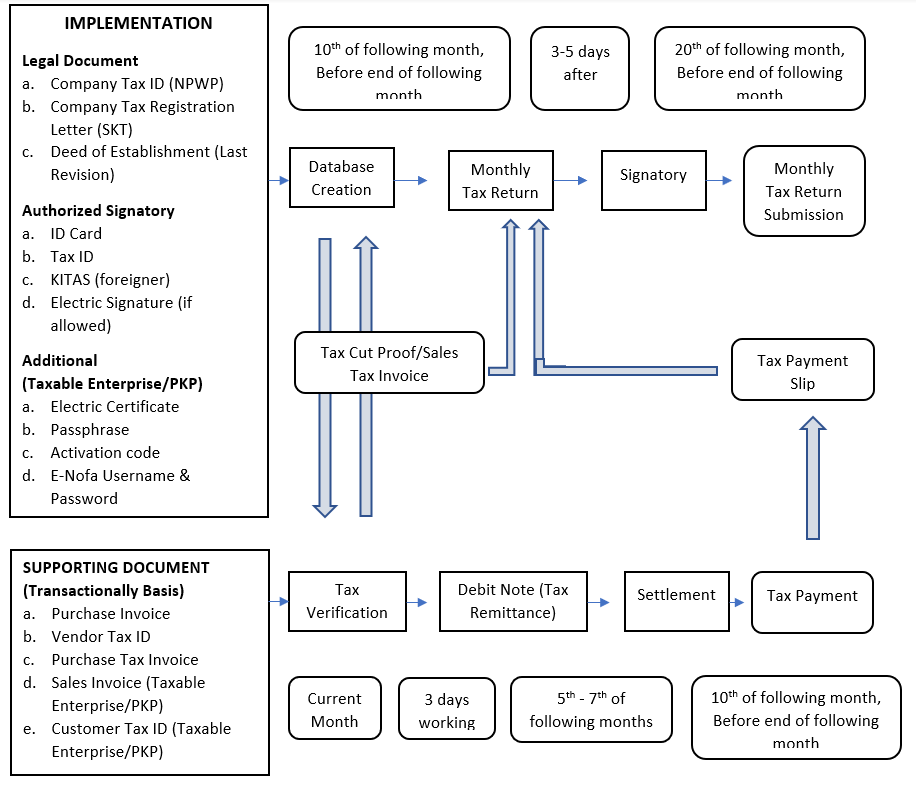

D. Tax Consulting Indonesia: Workflow & Timeline Schedule

E. Why Choose Abisnis as Your Tax Outsourcing Provider?

- HIGH-QUALITY SERVICE

We constantly provide high-quality service by seeking to understand your issues and needs. Our solutions are personalized for each business.

- EXPERIENCED TAX SPECIALISTS

Because of our years of professional experience, we are the best at what we do. Abisnis has a team of accounting staff and tax specialists who have the right skills to get the job done and will not stop until the client is satisfied.

- COMPLETE PACKAGE

We do not take things lightly. To ensure client satisfaction, we provide a comprehensive package that includes accounting, tax reporting, and auditing services.

- TIME & COSTS SAVING

Outsourcing accounting and tax operations allow you to save time and money. You can focus your skills on business strategies that will help your company grow.